The history of the W&W Group Our experience for your future

The companies of the W&W Group can look back on a long history. Their roots go back to 1828 and thus combine more than 190 years of experience in serving their customers.

Tradition and evolution 2024: Wüstenrot turns 100 and continues to grow

Wüstenrot Bausparkasse AG and the magazine ‘Mein Eigen-Heim’ are celebrating their 100th anniversary. In this anniversary year, the Bauspar Museum (building on the left), located in the former residence of Bausparkasse founder Georg Kropp, is being expanded (building on the right) to provide more usable space and room for conferences and exhibitions. The keynote speech was given by former Federal President Prof. Dr Horst Köhler.

In addition, Wüstenrot will become the new owner of start:bausparkasse AG (formerly Deutscher Ring Bausparkasse).

Further development within the W&W Group 2023: New headquarter and consolidation of value creation

The W&W Group moves into its new headquarter in Kornwestheim: the W&W Campus. The state-of-the-art office complex offers around 4,000 workplaces and thus a new shared home for around 6,000 employees.

In addition, the vertical value chain of Württembergische Versicherung AG is being deepened with a 25% stake in the motor vehicle claims adjuster riparo GmbH.

W&W Interaction Solutions GmbH is founded 2021: treefin AG becomes W&W Interaction Solutions GmbH

In 2021, treefin AG will change its name to W&W Interaction Solutions GmbH and thus focus on the development and operation of customer interaction and data analytics solutions. As an agile software developer, W&W Interaction Solutions GmbH designs, among other things, portals and apps or optimizes digital processes for its partners from the financial services industry.

Continuing on course for growth 2018: Wüstenrot acquires Aachener Bausparkasse

With the takeover of Aachener Bausparkasse AG (ABAG), Wüstenrot Bausparkasse AG continues on its growth path. Existing portfolios are taken over and the sales force of the cooperative building society is expanded to include several new major insurers. The market position is strengthened.

Corporate Startup 2017: Foundation of Adam Riese GmbH

Adam Riese GmbH was founded by the W&W Group in 2017. In this young corporate start-up, insurance is rethought: simple products of high quality, consistently priced according to need and risk. As an independent company and with its own brand, Adam Riese sees itself as a direct insurer for those who want to focus on the essentials. Insuring not by rule of thumb - but according to Adam Riese. Only what counts.

Takeovers and sales cooperation 2009: Wüstenrot on the path to growth

In 2009, Wüstenrot acquired Victoria Vereinsbank Bauspar AG based in Munich. One year later, Wüstenrot Bausparkasse also took over Allianz Dresdner Bauspar AG in Bad Vilbel (near Frankfurt). Sales cooperation with the ERGO Group, HypoVereinsbank and Allianz subsequently further strengthen the sales force of Wüstenrot Bausparkasse.

A common logo 2008: Modernisation of W&W commences

In 2008, the Group adopted a uniform brand image. The red W&W square has stood for a common culture since February 2008 and connects the parts of the Group as a common theme.

Württembergische takes over Karlsruher 2005: Acquisition Karlsruher Lebensversicherung AG

In October 2005, Württembergische Versicherung acquired a majority stake in the Karlsruher Insurance Group. Over the course of several years, the Karlsruher companies are merged with the companies of the Württembergische Versicherung. The Karlsruher brand is retained as a special sales brand.

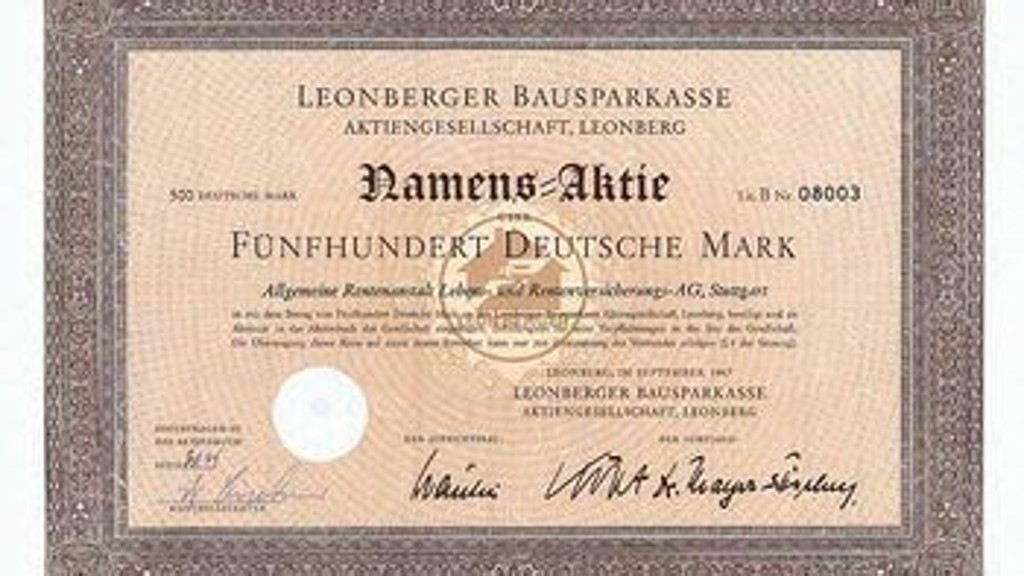

Wüstenrot grows 2001: Merger with Leonberger Bausparkasse AG

Wüstenrot Bausparkasse AG merged with Leonberger Bausparkasse AG. The Württembergische Insurance Group has held a majority interest in the company since 1974.

The foundation of the W&W Group 1999: Wüstenrot and Württembergische merge

In 1999, the long-established companies Wüstenrot and Württembergische merged to form the Wüstenrot & Württembergische Group (W&W). Their product portfolios perfectly complements each other.